operating cash flow ratio negative

Operating Cash Flow Total Revenue Operating Expense 2 Indirect Method Operating Cash Flow Formula The indirect method is adjusted net income from changes in all non-cash. In the first scenario above you could use the operating profit margin ratio formula to find the companys operating profit margin by dividing 200000 by 500000 to get 04 or.

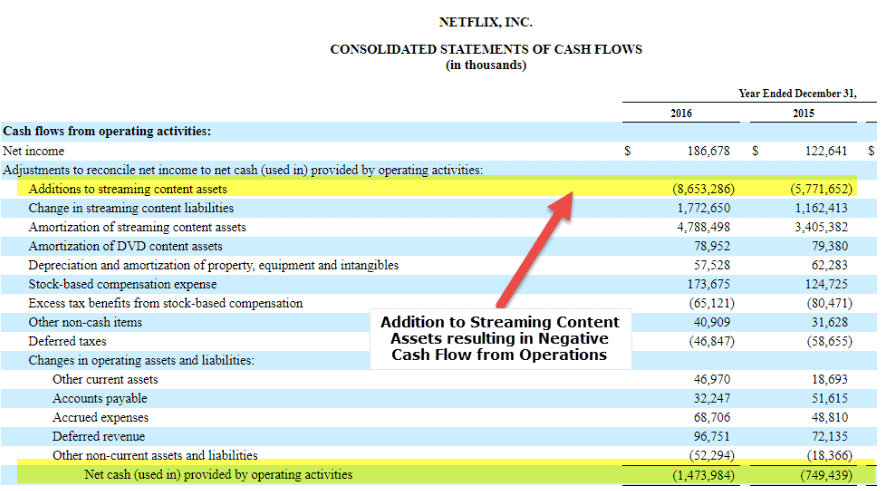

Cash Flow It S Not The Bottom Line

If a company fails to achieve a positive.

. This ratio gives you an idea about the companys debt. A key advantage of the operating cash flow ratio is that cash flows are generally considered to be a better indicator of financial condition than a firms reported profits. Negative operating cash flows can only occur when 1 the companys net income was negative in the first place or 2 when the firm faced a substantial increase in its working.

In the first scenario above you could use the operating profit margin ratio formula to find the companys operating profit margin by dividing 200000 by 500000 to get 04 or. A negative Operating Cash Flow indicates that a company is not generating sufficient cash flow from its core business operations and therefore needs to generate additional positive cash. Although negative cash flow means there is an imbalance in the revenue stream.

Negative cash flow is when your business has more outgoing than incoming money. You cannot cover your expenses from sales alone. Operating cash flows also known as cash flow from operations is a category in the cash flow statement and.

How can we calculate the Operating Cash to Debt Ratio. Cash Conversion Ratio CCR Operating cash flow EBITDA. Negative cash flow occurs when a business spends more than it makes within a given period.

A negative cash flow margin is an indicator that the company is losing money. Operating cash flow is intensely scrutinized by investors as it provides vital information about the health and value of a company. This might be due to high expenses uncollected accounts receivable or other factors.

The Operating Cash to Debt ratio is calculated by dividing a companys cash flow from operations by its total debt. The more accurate method is to subtract the cash used to pay off dividends as it will give a truer picture of the operating cash flows. Operating Cash Flow Operating Income Depreciation Taxes Change in Working Capital.

What is negative cash flow.

Negative Cash Flow Meaning Examples How To Interpret

Negative Working Capital Formula And Calculation

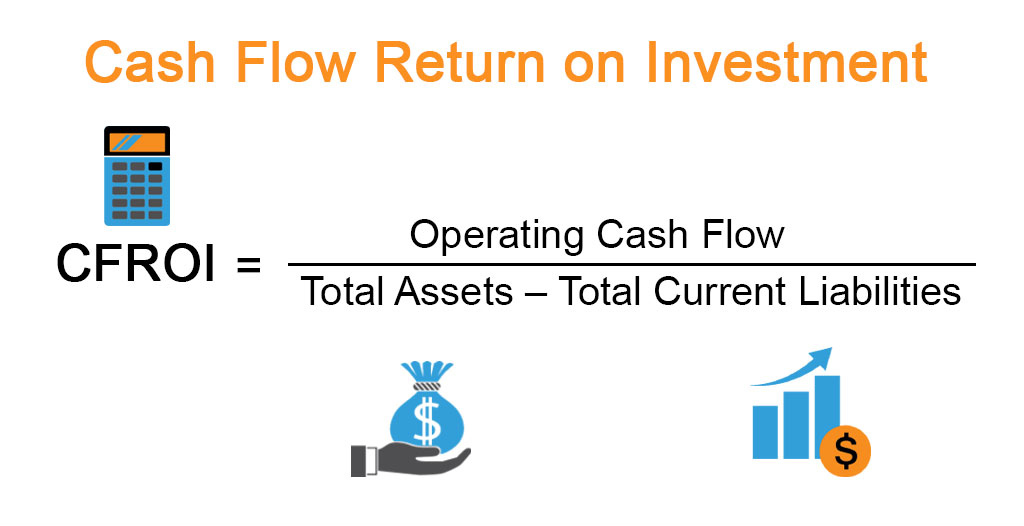

Cash Flow Return On Investment Examples With Excel Template

7 Cash Flow Ratios Every Value Investor Should Know

Operating Cash Flow Ratio Definition And Meaning Capital Com

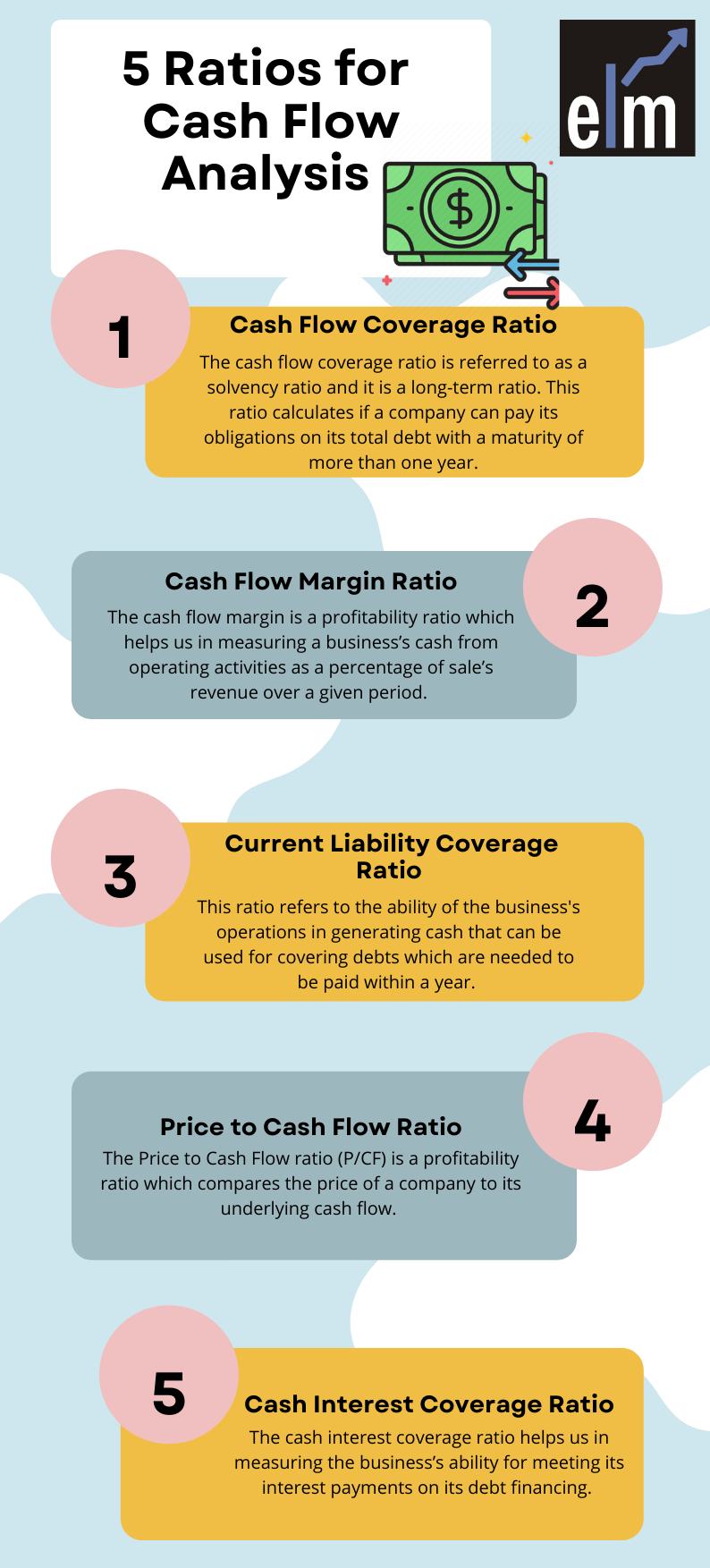

5 Important Ratios For Effective Cash Flow Analysis Elm

Operating Cash Flow Ratio Powerpoint Templates Slides And Graphics

Free Cash Flow Efinancemanagement

Free Cash Flow Fcf Formula Calculation Types Getmoneyrich

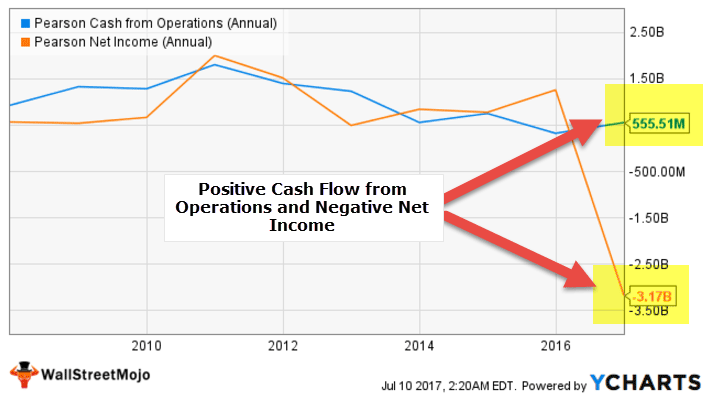

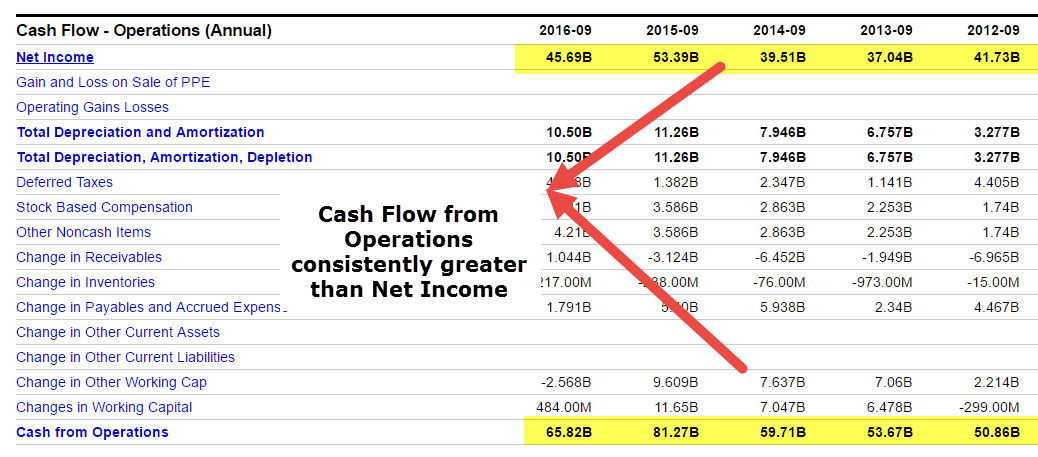

Cash Flow Vs Net Income Key Differences Top Examples

What Is Operating Cash Flow Ocf Definition Meaning Example

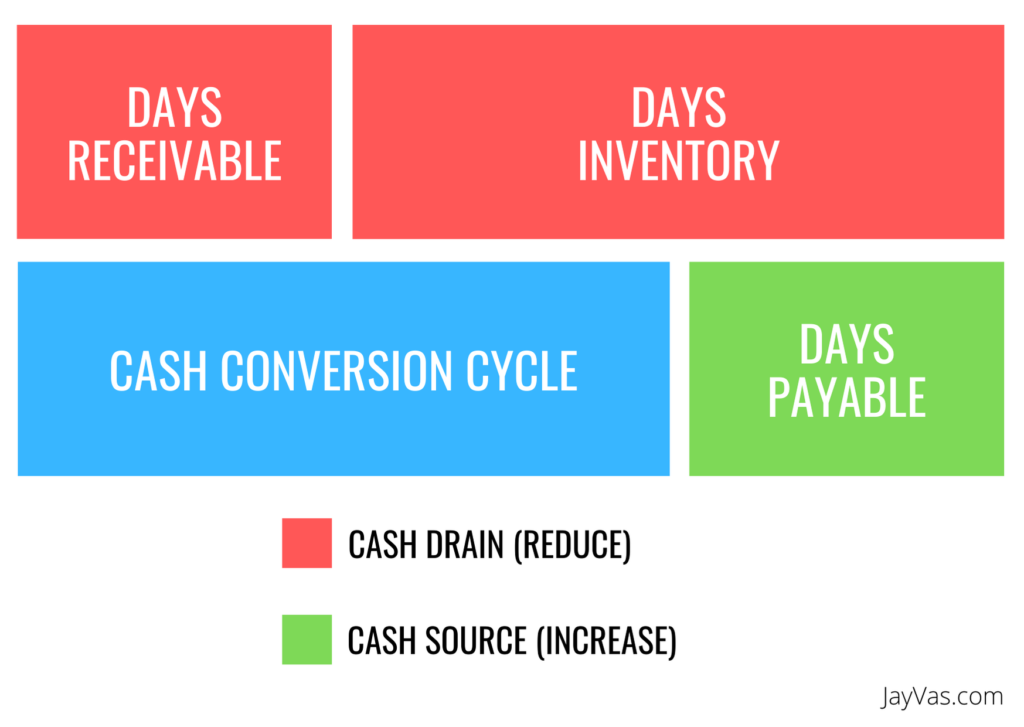

The Power Of Having A Negative Cash Conversion Cycle Jayvas Com

Cash Flow From Operations Formula Example How To Calculate

Net Cash Flow An Overview Sciencedirect Topics

Basic Cash Flow Statement Video Khan Academy

Cash Flow From Operating Activities Direct And Indirect Method Efm

7 Cash Flow Ratios Every Value Investor Should Know